All Categories

Featured

Table of Contents

Maintaining all of these acronyms and insurance coverage types straight can be a headache. The following table puts them side-by-side so you can rapidly differentiate amongst them if you obtain confused. One more insurance policy protection kind that can repay your home loan if you pass away is a basic life insurance coverage plan

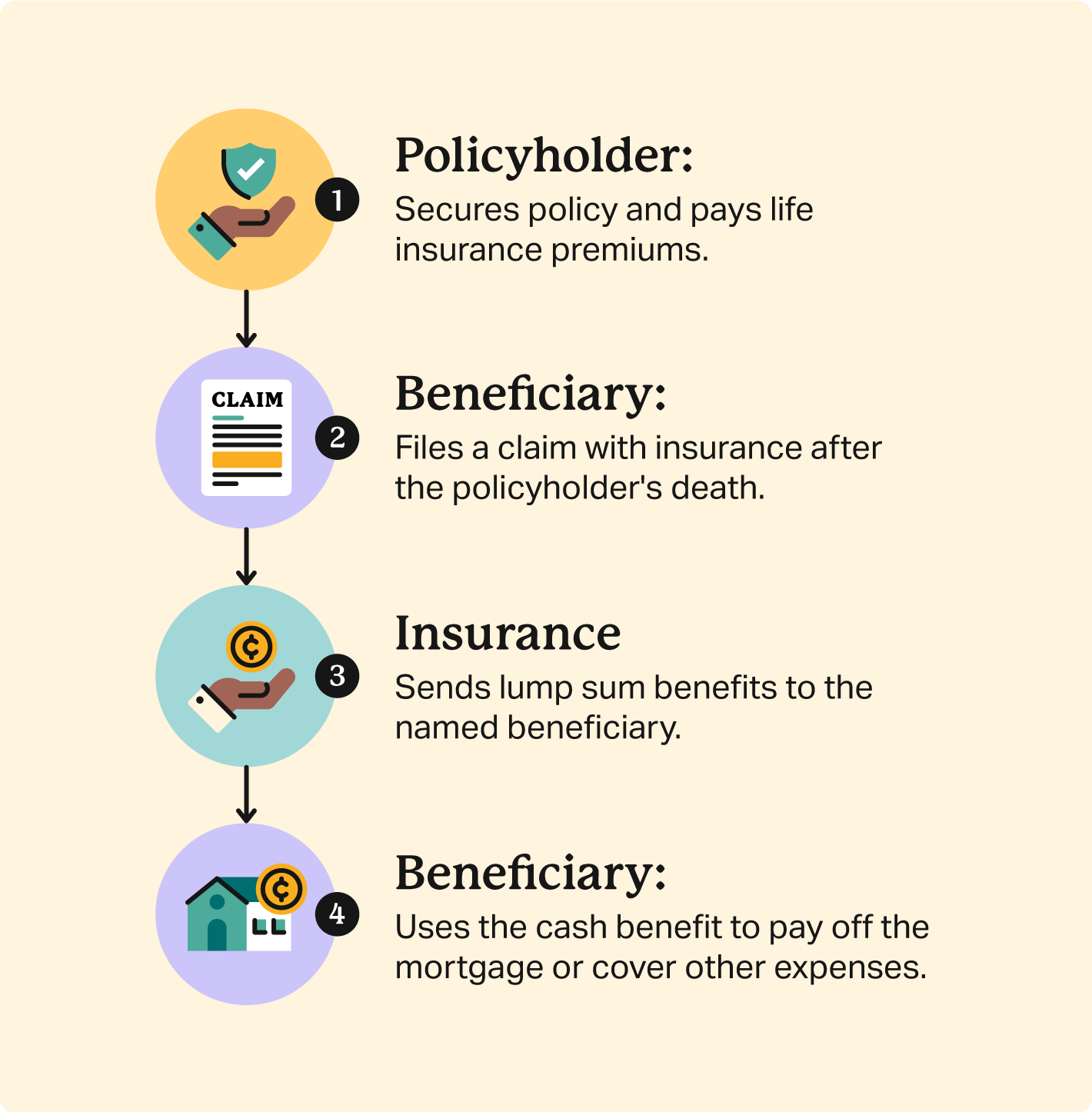

An is in area for a set variety of years, such as 10, 20 or three decades, and pays your recipients if you were to die throughout that term. An offers coverage for your entire life expectancy and pays out when you die. Instead of paying your home mortgage loan provider directly the method home loan security insurance does, standard life insurance policy plans most likely to the beneficiaries you select, who can then select to pay off the home mortgage.

One common rule of thumb is to intend for a life insurance policy plan that will certainly pay as much as 10 times the insurance policy holder's income amount. You could choose to utilize something like the Penny approach, which includes a family members's financial debt, revenue, home loan and education expenses to compute exactly how much life insurance is required.

There's a factor brand-new homeowners' mailboxes are typically bombarded with "Last Possibility!" and "Urgent! Activity Needed!" letters from mortgage protection insurance providers: Many only allow you to acquire MPI within 24 months of closing on your home loan. It's likewise worth keeping in mind that there are age-related restrictions and thresholds imposed by virtually all insurance companies, that frequently won't give older buyers as numerous alternatives, will bill them more or might deny them outright.

Right here's how mortgage defense insurance policy determines up versus conventional life insurance policy. If you're able to qualify for term life insurance policy, you must prevent mortgage security insurance (MPI).

In those circumstances, MPI can give terrific tranquility of mind. Simply make sure to comparison-shop and read every one of the great print before registering for any kind of policy. Every home loan defense alternative will certainly have many policies, guidelines, advantage choices and drawbacks that need to be evaluated carefully versus your exact circumstance (is mortgage insurance same as home insurance).

Insurance On A Mortgage Loan

A life insurance coverage policy can aid repay your home's home mortgage if you were to die. It is just one of several methods that life insurance policy may help protect your loved ones and their financial future. One of the most effective ways to factor your home loan into your life insurance policy demand is to speak with your insurance coverage agent.

As opposed to a one-size-fits-all life insurance policy plan, American Domesticity Insurance provider uses policies that can be designed particularly to fulfill your family's needs. Right here are several of your options: A term life insurance policy policy. mortgage insurance loan is active for a specific quantity of time and commonly provides a bigger quantity of coverage at a lower cost than a permanent plan

Instead than just covering an established number of years, it can cover you for your entire life. It likewise has living advantages, such as money value build-up. * American Household Life Insurance coverage Firm supplies various life insurance coverage plans.

Your representative is a terrific source to address your concerns. They might likewise be able to aid you locate voids in your life insurance policy coverage or brand-new methods to minimize your other insurance coverage. ***Yes. A life insurance policy beneficiary can pick to make use of the death advantage for anything - allstate mortgage disability insurance. It's a fantastic way to help guard the economic future of your household if you were to die.

Life insurance is one means of aiding your household in paying off a home mortgage if you were to pass away before the home mortgage is entirely paid off. Life insurance coverage profits might be used to assist pay off a home loan, but it is not the exact same as home mortgage insurance coverage that you might be required to have as a problem of a loan.

Mortgage Policy Insurance

Life insurance policy might aid guarantee your house stays in your family members by giving a survivor benefit that might help pay for a home mortgage or make crucial acquisitions if you were to die. Call your American Household Insurance policy agent to discuss which life insurance policy best fits your demands. This is a short description of protection and undergoes plan and/or biker terms, which may vary by state.

The words life time, lifelong and permanent go through plan conditions. * Any type of financings taken from your life insurance policy policy will certainly accrue interest. life mortgage group. Any type of exceptional finance equilibrium (loan plus rate of interest) will certainly be subtracted from the fatality advantage at the time of insurance claim or from the cash money value at the time of surrender

Price cuts do not use to the life plan. Plan Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage defense insurance coverage (MPI) is a various kind of secure that might be helpful if you're incapable to repay your home loan. Home mortgage defense insurance coverage is an insurance coverage plan that pays off the remainder of your mortgage if you pass away or if you become disabled and can not function.

Both PMI and MIP are called for insurance policy coverages. The quantity you'll pay for home mortgage protection insurance policy depends on a range of factors, consisting of the insurance provider and the existing balance of your home loan.

Still, there are advantages and disadvantages: A lot of MPI plans are issued on a "ensured approval" basis. That can be useful if you have a health and wellness condition and pay high prices forever insurance policy or battle to get protection. is life insurance compulsory with a mortgage. An MPI policy can supply you and your household with a feeling of security

Mortgage Insurance For Seniors

It can likewise be helpful for individuals that do not certify for or can't afford a traditional life insurance policy plan. You can choose whether you require home loan security insurance policy and for for how long you need it. The terms typically range from 10 to three decades. You may desire your home loan defense insurance term to be close in length to for how long you have actually delegated pay off your home mortgage You can cancel a home loan defense insurance plan.

Table of Contents

Latest Posts

Funeral And Life Cover

Does Insurance Cover Funeral Costs

Understanding Fixed Interest Annuity Vs Variable Investment Annuity Everything You Need to Know About What Is A Variable Annuity Vs A Fixed Annuity Breaking Down the Basics of Investment Plans Benefit

More

Latest Posts

Funeral And Life Cover

Does Insurance Cover Funeral Costs