All Categories

Featured

Table of Contents

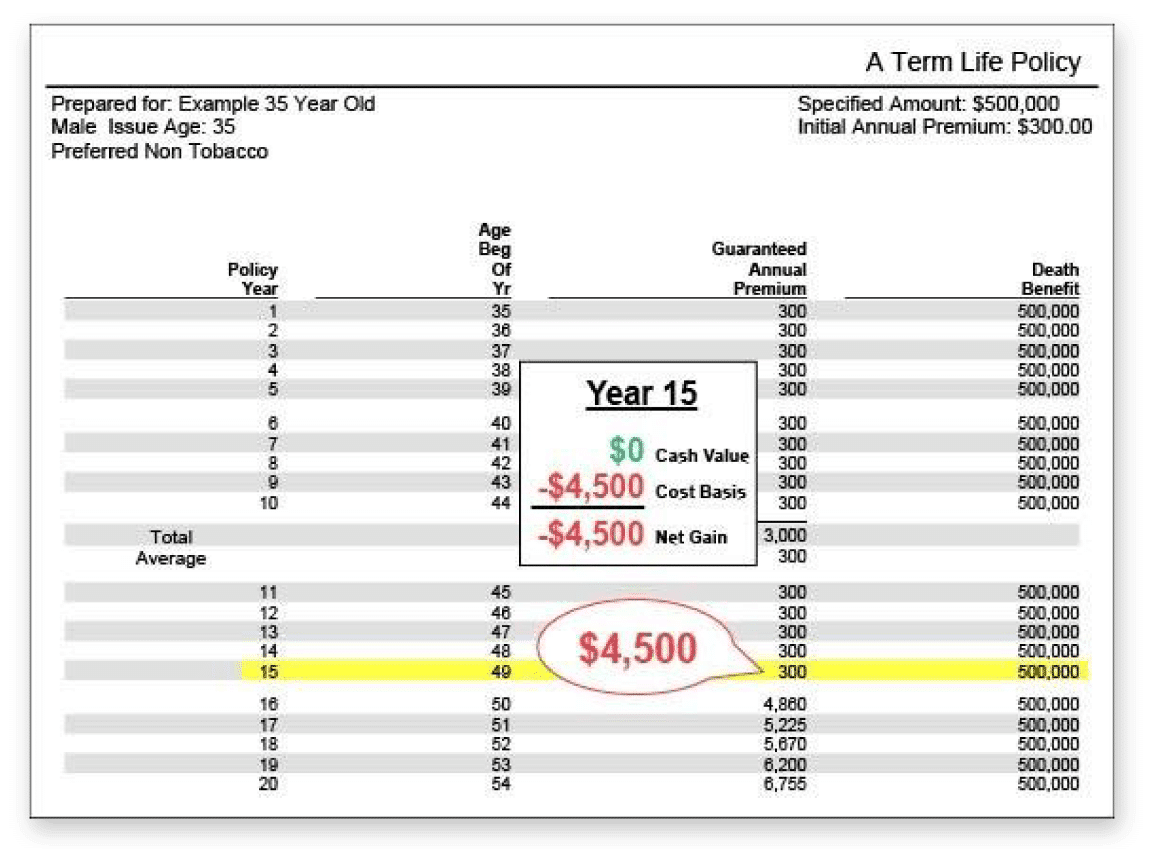

A degree term life insurance plan can offer you comfort that individuals who rely on you will certainly have a death benefit during the years that you are preparing to support them. It's a means to assist deal with them in the future, today. A degree term life insurance policy (occasionally called level costs term life insurance policy) plan provides insurance coverage for a set variety of years (e.g., 10 or two decades) while maintaining the premium repayments the very same throughout of the plan.

With degree term insurance policy, the price of the insurance will certainly stay the exact same (or possibly decrease if rewards are paid) over the term of your policy, typically 10 or two decades. Unlike permanent life insurance, which never ever runs out as long as you pay premiums, a level term life insurance policy will certainly end at some time in the future, typically at the end of the period of your level term.

The Basics: What is Level Term Life Insurance?

As a result of this, lots of people make use of irreversible insurance policy as a steady financial preparation device that can offer lots of needs. You may be able to convert some, or all, of your term insurance policy during a set period, commonly the initial one decade of your plan, without needing to re-qualify for insurance coverage also if your health and wellness has actually altered.

As it does, you might want to contribute to your insurance protection in the future. When you initially obtain insurance, you might have little savings and a big home loan. Ultimately, your savings will certainly expand and your mortgage will certainly reduce. As this occurs, you may want to ultimately reduce your death benefit or think about converting your term insurance policy to a permanent plan.

Long as you pay your premiums, you can relax easy knowing that your loved ones will certainly receive a death benefit if you die throughout the term. Many term plans enable you the capacity to transform to long-term insurance without needing to take one more health examination. This can enable you to make use of the additional benefits of a long-term policy.

Degree term life insurance policy is one of the easiest paths right into life insurance coverage, we'll talk about the advantages and drawbacks to make sure that you can pick a strategy to fit your demands. Degree term life insurance coverage is one of the most typical and basic kind of term life. When you're searching for momentary life insurance policy strategies, degree term life insurance is one path that you can go.

The application process for level term life insurance policy is usually very straightforward. You'll load out an application which contains basic personal details such as your name, age, and so on along with a much more comprehensive questionnaire about your case history. Relying on the plan you want, you may need to take part in a clinical exam process.

The short response is no., for instance, let you have the comfort of fatality advantages and can build up cash money worth over time, suggesting you'll have a lot more control over your advantages while you're active.

What is Term Life Insurance For Spouse? A Beginner's Guide

Motorcyclists are optional provisions included in your policy that can offer you additional benefits and securities. Motorcyclists are a terrific means to include safeguards to your policy. Anything can occur throughout your life insurance term, and you intend to be prepared for anything. By paying just a bit extra a month, riders can provide the support you require in instance of an emergency situation.

This biker supplies term life insurance policy on your children with the ages of 18-25. There are instances where these benefits are developed into your policy, however they can likewise be available as a different addition that needs extra settlement. This biker gives an extra survivor benefit to your recipient should you pass away as the result of a crash.

Table of Contents

Latest Posts

Funeral And Life Cover

Does Insurance Cover Funeral Costs

Understanding Fixed Interest Annuity Vs Variable Investment Annuity Everything You Need to Know About What Is A Variable Annuity Vs A Fixed Annuity Breaking Down the Basics of Investment Plans Benefit

More

Latest Posts

Funeral And Life Cover

Does Insurance Cover Funeral Costs