All Categories

Featured

Table of Contents

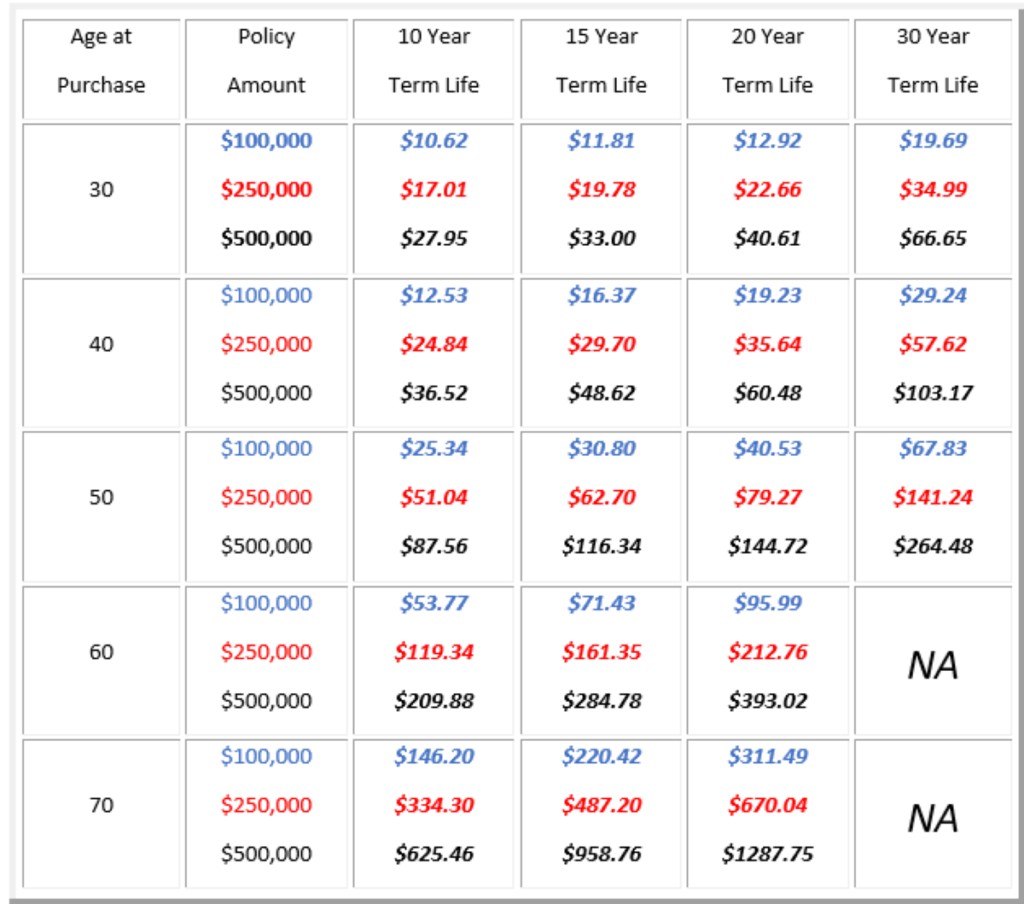

A level term life insurance policy plan can offer you tranquility of mind that the people who depend upon you will have a survivor benefit throughout the years that you are preparing to support them. It's a way to aid deal with them in the future, today. A level term life insurance policy (in some cases called degree premium term life insurance policy) policy gives protection for a set variety of years (e.g., 10 or 20 years) while keeping the premium repayments the same for the duration of the plan.

With degree term insurance policy, the cost of the insurance coverage will certainly remain the same (or potentially reduce if returns are paid) over the term of your policy, typically 10 or 20 years. Unlike irreversible life insurance policy, which never ever expires as lengthy as you pay premiums, a level term life insurance policy policy will finish at some point in the future, generally at the end of the duration of your level term.

Key Features of Level Term Life Insurance Definition Explained

As a result of this, many individuals utilize long-term insurance policy as a stable financial preparation tool that can offer many requirements. You may have the ability to convert some, or all, of your term insurance policy during a collection duration, typically the very first one decade of your plan, without requiring to re-qualify for protection even if your wellness has actually altered.

As it does, you might want to add to your insurance policy protection in the future - 10-year level term life insurance. As this occurs, you might want to at some point lower your fatality advantage or take into consideration transforming your term insurance policy to a permanent policy.

Long as you pay your premiums, you can relax simple understanding that your enjoyed ones will obtain a fatality benefit if you die during the term. Several term policies allow you the capability to convert to long-term insurance without needing to take an additional health and wellness exam. This can permit you to make use of the fringe benefits of a permanent policy.

Level term life insurance policy is one of the easiest paths right into life insurance policy, we'll discuss the benefits and downsides so that you can pick a plan to fit your demands. Level term life insurance policy is the most typical and standard type of term life. When you're searching for momentary life insurance plans, level term life insurance policy is one route that you can go.

You'll fill up out an application that contains basic personal info such as your name, age, etc as well as a more comprehensive set of questions about your clinical history.

The brief response is no., for example, allow you have the comfort of fatality advantages and can build up cash value over time, meaning you'll have more control over your benefits while you're to life.

What is Life Insurance Level Term Coverage?

Riders are optional provisions added to your plan that can give you additional advantages and securities. Anything can occur over the program of your life insurance term, and you desire to be all set for anything.

There are circumstances where these advantages are developed right into your plan, but they can likewise be readily available as a different addition that needs added payment.

Table of Contents

Latest Posts

Funeral And Life Cover

Does Insurance Cover Funeral Costs

Understanding Fixed Interest Annuity Vs Variable Investment Annuity Everything You Need to Know About What Is A Variable Annuity Vs A Fixed Annuity Breaking Down the Basics of Investment Plans Benefit

More

Latest Posts

Funeral And Life Cover

Does Insurance Cover Funeral Costs